Beyond the AI Sell-Off: A Healthy Pruning for Exponential Growth – JIL’s Take on AI

- investment33

- Nov 9, 2025

- 5 min read

Updated: Nov 21, 2025

Dear Readers,

With a readership that spans the corridors of Wall Street to the boardrooms of Beijing—Solomon Grey Capital has long been your unflinching guide through the tempests of global markets. Today, I wade into the froth of the latest AI maelstrom, sparked by the Financial Times’ stark headline on the near-$1 trillion evaporation in Big Tech valuations. It’s the worst week for AI-tied stocks since April, a brutal reminder that even the most hyped revolutions come with bloodletting. The trigger? A cocktail of frothy valuations, whispers of an “AI bubble,” and sobering words from the titans of finance. Morgan Stanley and Goldman Sachs CEOs have sounded the alarm on overreach, sending Nvidia, Microsoft, and their peers tumbling as investors flee the perceived mirage of endless upside.

But here’s my unvarnished take: This isn’t a bubble bursting—it’s a branch being pruned. As a self-confessed long-term apprentice to AI’s alchemy (I’ve tracked its arc since the heady days of GPT-2 demos in 2019, when neural nets were still more parlor trick than powerhouse), I see this dip not as doom, but as the market’s way of separating wheat from chaff. The sell-off, clocking in at around $800 billion to $1 trillion across the Magnificent Seven, forces a reckoning: Which AI bets are transformative, and which are just expensive vaporware? Spoiler: The transformative ones will emerge leaner, hungrier, and poised to redefine prosperity.

To frame this, let’s eavesdrop on the oracle class—the market movers who’ve shaped (and sometimes scarred) the AI narrative. Their recent musings, culled from earnings calls, podcasts, and fireside chats, paint a mosaic of caution laced with conviction.

Start with Goldman Sachs’ David Solomon, whose firm just dropped a 40-page treatise titled AI: In a Bubble? In a CNBC interview last month, Solomon didn’t mince words on the risks: AI’s massive capex binge—trillions funneled into data centers and chips—has investors “overlooking things you should be skeptical about,” potentially priming a broader market drawdown. Yet, in the same breath, he pivots to optimism, arguing that AI-fueled productivity is our “path out” of fiscal sclerosis. “The difference between compounding growth of 3% and 2% is monstrous in terms of dealing with this issue,” he told Fortune, nodding to America’s ballooning debt pile. Solomon’s Goldman isn’t bearish; it’s betting on AI as the deficit dragon-slayer.

Contrast that with Citadel’s Ken Griffin, the quant kingpin whose hedge fund empire thrives on alpha extraction. At the JPMorgan Robin Hood conference in October, Griffin poured cold water on generative AI’s hedge-fund hype: “It will have impact, but one that won’t be profound,” he said, dismissing it as failing to deliver the edge funds crave. No widespread revolution here—just incremental tweaks. Griffin’s words sting because Citadel is all-in on AI infrastructure; he juiced Nvidia holdings by 414% in Q2 2025 alone. His skepticism? It’s the voice of the practitioner, reminding us that AI’s promise often falters in the gritty trenches of real-time trading.

Then there’s Jeff Bezos, the e-commerce emperor turned space visionary, who remains defiantly upbeat. At Italian Tech Week in October, he scoffed at the doomsayers: “I don’t see how anybody can be discouraged who is alive right now,” Bezos declared, forecasting “gigantic” benefits from AI across industries. He even conceded the bubble—“it’s real,” he admitted to Yahoo Finance—but countered that the underlying tech is no illusion, poised to supercharge companies and societies alike.

Bezos, ever the long-game player, envisions AI not as a Wall Street casino chip, but as the engine for his Blue Origin dreams: robots commuting to the Moon, millions orbiting in habitats by 2045. And no AI discourse is complete without Elon Musk, the chaos conductor whose X posts and podcasts are scripture for the faithful. On Joe Rogan’s show last week, Musk issued his latest “AI warning”: Expect “a lot of trauma” as jobs evaporate, but in a “benign scenario” (his hedge against Terminator dystopias), the upside is epochal—he’s “bullish on the long-term benefits.”

Earlier, at a New York event, he went further: AI will “replace all jobs,” rendering work “optional” worldwide. “It’s game over, folks.” Musk’s Tesla is already prototyping “gigantic” chip fabs for AI and robotics, and his X rants—from diffusion models revolutionizing video gen to edge compute dominating 90% of AI loads—betray a man racing toward singularity, undeterred by market wobbles.

These voices—spanning skepticism (Griffin), guarded hope (Solomon), unbridled enthusiasm (Bezos), and existential gamble (Musk)—encapsulate the AI zeitgeist. The FT’s sell-off saga amplifies the discord: Valuations soared on ChatGPT euphoria, only to crater as capex realities bite and ROI timelines stretch. But as my apprenticeship has taught me, AI’s true north isn’t quarterly earnings; it’s the inexorable march toward efficiency. And that’s where I plant my flag with fervent optimism.

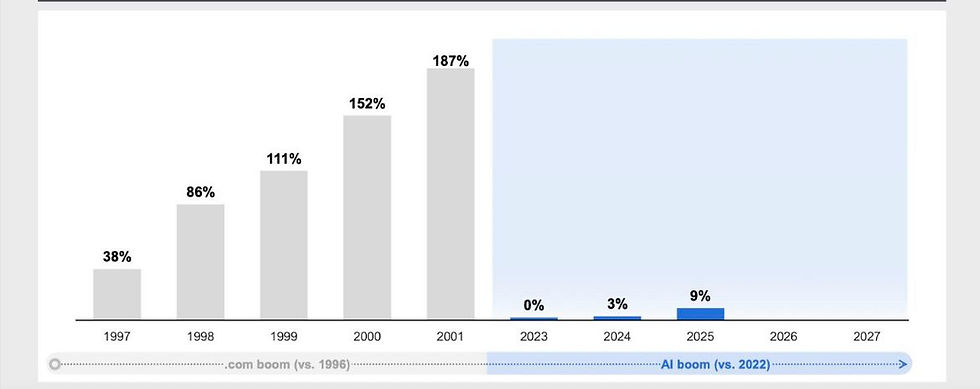

Economically, this is dynamite disguised as debris. AI isn’t just automating tasks—it’s compounding human ingenuity at scales we haven’t seen since the steam engine. Solomon’s 3% vs. 2% growth delta? That’s not hyperbole; McKinsey pegs AI’s potential to add $13 trillion to global GDP by 2030 through productivity surges in everything from drug discovery to supply chains. The sell-off prunes the speculative fronds, channeling capital to winners like Tesla’s Dojo superclusters or Amazon’s custom silicon. Result? Faster iteration, lower costs, and a virtuous cycle where AI begets more AI. In a world groaning under $300 trillion in global debt, this efficiency tsunami could flip deficits to surpluses, funding infrastructure without tax hikes. Call me a techno-utopian if you must, but history backs it: The internet “bubble” of 2000 birthed Amazon and Google; today’s AI correction will birth the next titans.

Socially, the spin is even brighter—AI as liberator, not overlord. Musk’s “optional work” vision terrifies labor economists, but imagine it: Drudgery offloaded to algorithms means humanity unshackled for creation, caregiving, and communion. No more soul-crushing commutes or 80-hour weeks; instead, universal basic creativity. Bezos echoes this in his ABF 2025 speech, framing AI as a societal accelerator that tackles climate modeling, personalized medicine, and education equity. Goldman, too, downplays the “jobs freakout,” forecasting modest 4-11% headcount trims offset by new roles in AI oversight and ethics. The net? A better society, where efficiency amplifies abundance, narrowing inequality gaps as AI democratizes tools once reserved for elites. Griffin’s hedge-fund grumble? It’s the sound of old paradigms cracking—alpha from code, not carbon.

Opinionated as ever: This $1 trillion haircut is the market’s mercy kill on hype merchants, clearing decks for substantive builders. Ignore the noise; bet on the trajectory. AI’s S-curve is just inflecting—by 2030, we’ll look back on this as the dip that launched the decade.

This kicks off JIL’s Take on AI, a thread to dissect the revolution’s ripples.

In markets and machines,

John Ian Lau

Solomon Grey Capital

Follow the thread: #JILsTakeOnAI