JIL’s Take on AI

- investment33

- 6 days ago

- 3 min read

By John Ian Lau, Contributing Editor

January 4, 2026

Happy New Year!

Artificial intelligence continues to command the spotlight in global equity markets as 2026 gets underway, with institutional strategists broadly endorsing the theme even as bubble warnings persist. Bloomberg’s aggregation of more than 60 investment outlooks reveals near-universal optimism: Fidelity International describes AI as “the defining theme for equity markets” in 2026, while BlackRock’s Investment Institute anticipates the technology will “keep trumping tariffs and traditional macro drivers.” Goldman Sachs Research remains constructive on equities, forecasting durable hyperscaler AI capex into 2026—now estimated at a consensus $527 billion, with potential upside to $700 billion amid historical underestimation of spending.

The structural case for continued momentum is robust. Hyperscaler capital expenditure is projected to approach or exceed $500–600 billion in 2026 according to various analyst consensus figures, representing a significant but still modest share of U.S. GDP compared to prior tech cycles. This investment wave supports what NatWest and others call “a powerful engine of economic expansion,” with demand for compute power outstripping supply in critical segments.

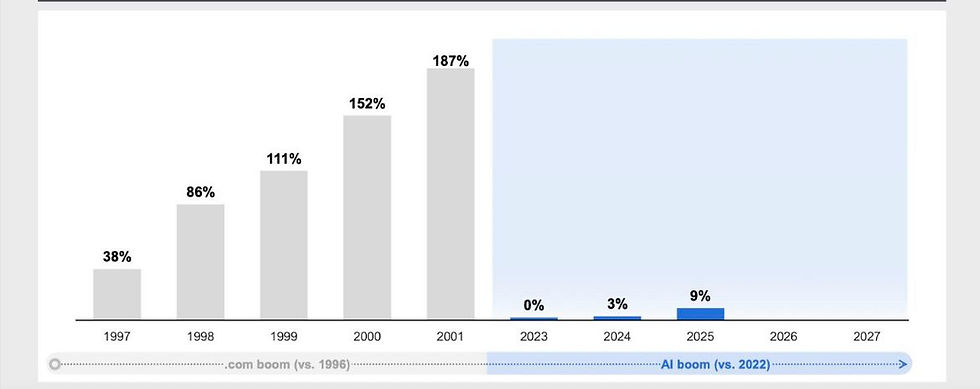

Yet the valuation debate remains intense. Alphabet CEO Sundar Pichai, in a widely cited BBC interview, acknowledged “elements of irrationality” in the trillion-dollar AI investment surge, warning that “no company is going to be immune” — including his own — if a bubble bursts, drawing parallels to the dot-com era’s overshoots. Oaktree Capital’s Howard Marks, in his recent memo “Is It a Bubble?,” highlights clear investor exuberance around AI while cautioning that bubbles are often recognized only in hindsight; he notes parallels to historical episodes of “irrational exuberance” but stops short of declaring a full-blown mania, emphasizing uncertainty around adoption timelines and returns.

Other voices amplify the caution. Renowned economist Ruchir Sharma has flagged the AI surge as checking all four boxes on his bubble checklist, predicting a potential 2026 trigger from higher interest rates that could crimp cheap capital availability and pressure growth-stock valuations. Michael Burry, the “Big Short” investor, has compared the boom to the dot-com era and positioned against aspects of it, while Goldman Sachs CEO David Solomon and Amazon’s Jeff Bezos have described elements of overinvestment and an “industrial bubble.” A Yale Insights analysis points to intertwined deals among tech giants as signs of dangerous circular financing, and MIT research has questioned returns on generative AI enterprise spending.

Concentration risks loom large: the Magnificent Seven — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla — continue to drive the bulk of S&P 500 gains, with forward P/Es in the low-to-mid 20s range for key players, elevated but not yet at dot-com extremes. BlackRock contrasts today’s profitable, self-funded leaders with the revenue-challenged firms of the late 1990s, yet warns of acute risks if capex momentum slows or earnings delivery falters.

From a macro lens, the post-2008 liquidity environment — with expanded money supply and compressed yields — continues to underpin elevated asset prices, making equity demand more elastic than inelastic supply. This dynamic bolsters the view that short-term volatility often masks a nascent megatrend, with institutional inflows from pensions, insurance, and family offices showing resilience.

For Solomon Grey Capital clients, the path forward demands selectivity. Favor established cash-flow generators and infrastructure providers with durable competitive advantages over more speculative exposures. Monitor capex trends closely — any deceleration could heighten downside risks — while positioning for broader AI adoption, agentic systems, and productivity gains that Stanford and Microsoft experts see unfolding in 2026.

In summary, most strategists do not yet see a full bubble, but the combination of exuberance, debt-financed buildouts, and uncertain monetization timelines calls for disciplined risk management. AI’s transformative potential remains intact; the challenge is capturing it without falling prey to over-optimism.