MicroStrategy’s Bitcoin Bet Backfires: From Premium Proxy to Negative NAV Nightmare

- investment33

- Nov 18, 2025

- 5 min read

Updated: Nov 21, 2025

By John Ian Lau

Contributing Editor

Solomon Grey Capital

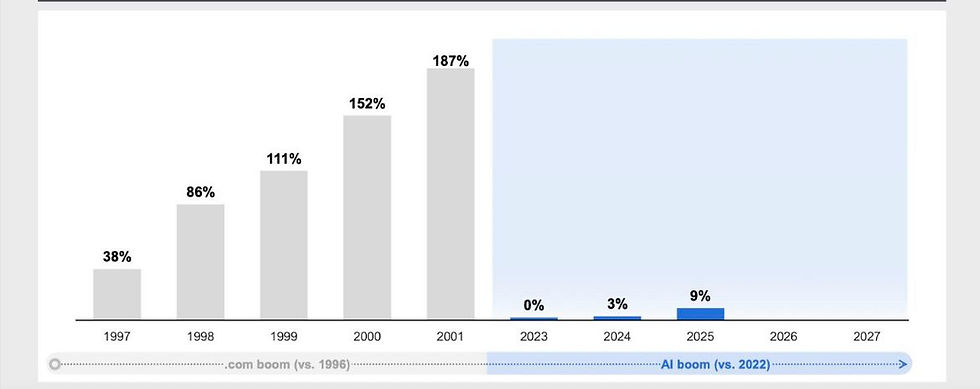

In the high-stakes world of corporate cryptocurrency gambles, few stories have captivated Wall Street like MicroStrategy’s audacious pivot to a Bitcoin treasury strategy. Once a staid enterprise software firm, the company—rebranded as Strategy Inc. in February 2025—has transformed under Executive Chairman Michael Saylor into the largest corporate holder of Bitcoin, amassing over 641,000 BTC worth approximately $65 billion at current prices. But as the crypto market’s post-peak euphoria fades, Strategy’s stock has cratered, plunging 40% in the past six months and 60% from its October highs. The ultimate indignity? Its market capitalization has dipped below the value of its Bitcoin holdings, yielding a rare negative net asset value (NAV) multiple—or mNAV—of around 0.94 as of November 17. For investors who once paid a 3x premium to bet on Bitcoin through MSTR shares, this marks a humiliating reversal.

The chart circulating on social media and financial forums tells a stark tale: a jagged line plummeting from a $70 billion premium in early 2025 to a $4 billion discount today. Strategy’s market cap hovers at $57 billion, while its BTC stash alone—acquired at an average cost of $74,000 per coin—now eclipses that figure amid Bitcoin’s slide from $126,000 in October to $101,000. “This isn’t just a correction; it’s a reckoning for the leveraged Bitcoin proxy trade,” says Gracy Chen, CEO of Bitget, who noted on X that the vanishing mNAV premium signals investors’ shift toward direct BTC exposure via spot ETFs, bypassing the corporate wrapper’s added risks.

The Anatomy of the Downfall

Strategy’s woes trace back to a perfect storm of macroeconomic headwinds, internal leverage, and waning retail frenzy. Bitcoin’s 25-30% correction since October—erasing most of its 2025 gains—has amplified the pain for a stock that Saylor himself dubbed “Bitcoin on steroids.” Higher-for-longer interest rates have jacked up the cost of the company’s $31 billion in debt and preferred shares, much of which funds relentless BTC accumulation. Q3 2025 earnings showed a headline $2.8 billion net income, but it was almost entirely unrealized BTC gains, with core software revenue flatlining at under $500 million annually.

Dilution fears have compounded the rout. Strategy’s “42/42 Plan”—an expansion of its original ambition to raise $42 billion for BTC buys by 2027—relies on at-the-market (ATM) equity issuances and high-yield preferreds like the 10.5% STRC series. While accretive when mNAV soared above 2x, these moves now feel punitive. “Raising $31.1 billion through dilution but only deploying half into actual BTC? That’s a red flag on investor appetite,” quips ByteTree analyst Tom Wan, who warned on X that the “end of the MicroStrategy premium” could trigger further selling.

Saylor, ever the evangelist, dismisses the panic. In a CNBC interview on November 14, he shot down rumors of BTC sales—“We’re buying, we’ll report our next buys on Monday”—and reiterated his conviction: “The volatility comes with the territory… There’s no doubt in my mind Bitcoin will be a larger asset class than gold by 2035.” Yet even he admitted in May that shareholders “would suffer” if BTC cratered 90% for years, a scenario now feeling uncomfortably plausible. The company’s latest disclosure: an $835.6 million purchase of 8,178 BTC on November 17, even as shares hit 52-week lows near $200.

Analysts are split. Out of 15 covering MSTR, 12 rate it “Strong Buy” with an average target of $523—implying 120% upside if Bitcoin rebounds. But bears like Jim Chanos, the legendary short-seller who closed his MSTR position in November, see structural rot. “mNAV compression from 2.5x to 1.23x? It’s heading to 1.0x, and that’s optimistic,” Chanos told TheStreet Crypto. Crypto analyst Toby Cunningham goes darker: “When Strategy collapses and Saylor sells BTC, it’ll be at the bottom of the next bear market.”

Lessons from the Pack: How Other DATs Are Faring

Strategy’s blueprint—inspired by Satoshi Nakamoto’s “digital gold”—has spawned a cottage industry of digital asset treasury (DAT) companies, but few match its scale or scrutiny. Here’s a snapshot of comparables as of November 2025, per BitcoinTreasuries data:

• Metaplanet (Tokyo-listed, MTPLF): Asia’s “MicroStrategy,” this Japanese hotel operator holds 7,800 BTC ($872 million) after adopting a BTC-first strategy in 2024. Shares are up 3,000% in 18 months, with mNAV at 1.8x—buoyed by yen devaluation hedges. CEO Simon Gerovich aims for 10,000 BTC by year-end, but warns of “drawdowns like MSTR’s” in volatile cycles.

• Semler Scientific (SMLR): A medical device firm with 1,762 BTC ($165 million), Semler doubled down post-2024, with shares up 150% YTD. mNAV hovers at 1.4x, less leveraged than Strategy’s. CEO Eric Semler, a Saylor acolyte, tweeted: “Why haven’t more public companies adopted Bitcoin treasury? It’s the ultimate asymmetric bet.”

• MARA Holdings (MARA): A Bitcoin miner with 25,000+ BTC ($2.5 billion), MARA trades at a 0.85x mNAV—deeper in discount territory than Strategy. Shares are down 35% YTD amid mining margin squeezes, but CEO Fred Thiel calls it a “buying opportunity” for hashrate expansion.

• Riot Platforms (RIOT): Another miner with 10,000 BTC ($1 billion), Riot’s mNAV is 0.9x, reflecting sector-wide energy cost woes. Down 45% YTD, it’s a cautionary tale for over-leveraged DATs.

• Tesla (TSLA): The outlier holds 11,509 BTC ($1.15 billion) since 2021, but at a negligible 0.2% of its $1.2 trillion market cap. mNAV irrelevant here; Elon Musk’s sporadic buys keep it tangential.

These peers highlight Strategy’s unique peril: its 3% claim on BTC supply amplifies beta to the coin, but without mining revenue or diversified ops, it’s a pure volatility amplifier. As Pierre Rochard of Bitcoin for Corporations notes on X: “MSTR’s underperformance is from over-outperforming in 2024—now BTC volatility cools, and financing pivots add short-term discounts, but long-term value accrues.” Metaplanet and Semler, with lighter debt loads, have held premiums better, suggesting Strategy’s $4 billion negative NAV isn’t inevitable for all DATs.

Saylor’s Defiance Amid the Wreckage

Big commentators aren’t mincing words. Fidelity’s Chris Kuiper attributes the slide to “long-term holder fatigue,” with BTC lagging gold and the S&P 500. Jason Yanowitz of Blockworks calls it “the end of @MicroStrategy ($MSTR)?”—echoing X sentiment where mNAV trackers like @yourfriendSOMMI alert: “Officially turns DISCOUNT NEGATIVE mNAV.” Yet bulls like Dylan LeClair of Metaplanet frame drawdowns as par for the course: “We’ve seen 50-60% drops in 18 months while fundamentals strengthen.”

Saylor, whose personal wealth has shed $4 billion in six months, remains unbowed. “Bitcoin outperforms everything,” he told Fortune in February, eyeing $13 million per coin by 2045. In a Yahoo Finance interview last week, he doubled down: “I don’t think [believers] are losing faith.” But with executive stock sales—$10 million in November alone—and Arkham Intelligence flagging wallet shuffles, whispers of a “Saylor dump” persist. (Saylor refutes it: “HODL.”)

Whither Strategy? Opportunity or Oblivion?

For the faithful, this negative NAV is a fire sale: Strategy’s software arm still generates $100 million quarterly in cloud subscriptions, and its 21/21 Plan (now 42/42) could balloon holdings to 1 million BTC if markets thaw. Cantor Fitzgerald’s October note projects $4 billion in 2025 profits from treasury ops alone. But bears warn of a “GBTC-style discount risk,” per Blockchain News, where closed-end fund dynamics trap value below assets.

As Bitcoin eyes $90,000 support, Strategy stands at a crossroads. Saylor’s vision of a $200 trillion asset class may yet vindicate the bet—or cement it as the dot-com era’s most spectacular flameout. For now, the mNAV chart’s red ink is a sobering reminder: In crypto’s casino, even the house can go bust.

John Ian Lau is a contributing editor at Solomon Grey Capital. Views are his own.