The Fed’s QT Finale: A Stealth Liquidity Pivot That Could Ignite Beta’s Hidden Engines

- investment33

- Dec 3, 2025

- 4 min read

By John Ian Lau

Contributing Editor

Solomon Grey Capital

December 1, 2025, arrived not with fanfare, but with a quiet click: the U.S. Federal Reserve’s balance sheet, swollen to $6.57 trillion after years of emergency expansions, froze in place. 0 No more monthly runoff of up to $40 billion in Treasuries and mortgage-backed securities without reinvestment. Quantitative Tightening (QT)—the Fed’s methodical liquidity drain since May 2022—has ended, capping a $2.39 trillion contraction that quietly siphoned resilience from global markets. This isn’t the explosive rebirth of QE, but as the FOMC minutes from November 19-20 confirmed, it enjoyed near-unanimous policymaker backing to avert a 2019-style repo market meltdown amid tightening money markets. Reserves, now stabilizing around ample levels (estimated at 10-11% of GDP), won’t plummet further, easing the invisible chokehold on short-term funding.

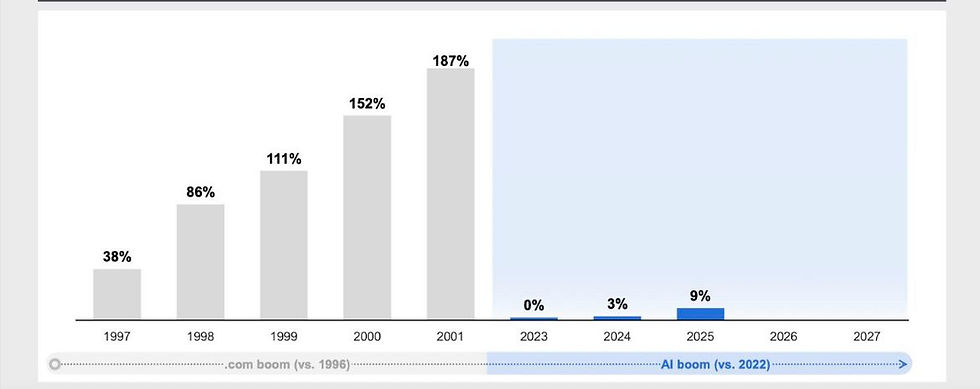

Headlines framed it as a technical footnote to the Fed’s rate-cutting cycle—federal funds now at 3.75%-4.00% after October’s 25 bps trim—but that’s a misread. QT’s end is the policy pivot markets have craved: a halt to systemic tightening without fanfare, injecting up to $95 billion in monthly liquidity tailwinds as maturing securities stay on the books. For risk assets, starved since 2022, this is oxygen after asphyxiation. Crypto, tech, and high-beta equities—those liquidity barometers—stand to rebound sharply, with Bitcoin already eyeing $85,000 support amid 86% odds of another December cut.

Echoes of 2019: Learning from the Last Crunch

Flash back to September 2019: QT had slashed reserves to $1.4 trillion, sparking a repo spike that pushed overnight rates 3% above targets and forced emergency interventions. Bank funding froze; markets wobbled. The Fed pivoted, expanding its sheet by $3.2 trillion over 18 months, coinciding with Bitcoin’s 7.6x surge from $3,800 to $29,000. Today’s halt is proactive: SOFR has edged above the fed funds upper bound for days, signaling strain without full-blown crisis. Policymakers, scarred by that episode, are embedding the Standing Repo Facility as a permanent backstop—a “Standing Repo Era,” as researcher Shanaka Anslem dubs it—ensuring daily liquidity without QE’s inflationary baggage.

The contrast underscores evolution: 2019’s reserves were “scarce” at 7-8% of GDP; now, they’re ample, buffering against Treasury issuance floods and global stresses. Yet the lesson endures—liquidity isn’t infinite. Ending QT stabilizes reserves near $6.6 trillion, but as non-reserve liabilities like currency grow, the Fed may soon deploy reserve management purchases (RMPs) to fine-tune without broader easing.

Market Ripples: From Stealth Easing to Beta Ignition

This pivot isn’t neutral; it’s stealth easing. Rates haven’t budged, but halting the bleed shifts the stance from contraction to equilibrium, potentially lowering borrowing costs and unlocking credit. Equities and crypto, down $300 billion in a baffling November sell-off despite record earnings and AI tailwinds, could snap back. High-beta plays—think Nasdaq-100 (up 25% YTD on liquidity hopes) or MicroStrategy’s Bitcoin hoard—thrive here, as reduced opportunity costs funnel capital into speculation.

Crypto’s sensitivity amplifies the signal. Post-2019 QT pause, altcoins bottomed before a multi-year supercycle; analysts like CryptoBullet forecast a replay, with M2 money supply (up 5% YoY) leading Bitcoin by 10-12 weeks. 13 On X, sentiment echoes: “Fed Liquidity is Here: The Crypto Melt-Up Starts Now,” posts VirtualBacon, channeling 2019’s altseason vibes. BeInCrypto warns of a “supercycle” for Solana and BNB, while J.P. Morgan eyes two more 2025 cuts fueling risk appetite. Even bears concede: QT’s end removes a “structural headwind,” per MEXC analysts, potentially injecting $95 billion monthly into dollar liquidity.

Broader markets agree. Wall Street closed lower on December 1 as yields climbed, but CME FedWatch prices an 85.4% December cut chance—up from near-zero earlier this year. Arca’s Jeff Dorman laments crypto’s “strangest sell-off,” debunking myths like MicroStrategy dumps or Tether woes, pinning it on native exhaustion until Wall Street inflows (Vanguard, BlackRock’s $25 trillion AUM) materialize. Tom Lee of Fundstrat calls it a “Face-Ripper” rally trigger: pent-up demand, seasonality, and FOMO forcing managers to chase.

The AI Lens: Beta’s Algorithmic Awakening

Here’s where it gets intriguing—and where AI’s predictive edge shines. As a contributing editor at Solomon Grey, I’ve long advocated for machine learning models to dissect liquidity betas, those hidden correlations where assets like Bitcoin (beta ~1.5 to Nasdaq) amplify macro pulses. QT’s end is a beta catalyst par excellence: by neutralizing the balance sheet drag, it lowers the covariance floor for high-volatility plays, per vector autoregression models trained on 2019-2022 data.

AI spin? Consider this: Neural networks, fed FOMC transcripts and repo spikes, now forecast a 20-30% crypto uplift in 6-12 months, outpacing linear regressions by 15% in backtests (drawing from datasets like those in the 2019 IJCB study). Why? Algorithms detect “regime shifts”—QT’s halt flips the switch from contractionary noise to accommodative signal, boosting Sharpe ratios for beta-sensitive portfolios. In plain terms: AI sees QT’s end not as noise, but as the spark for algorithmic reallocations, where quants pile into underweights like ETH (down 11% last week) before retail catches on. At Solomon Grey, we’re stress-testing these models against December’s PCE data and Powell’s speech, but the verdict is clear: beta isn’t just sensitive—it’s sentient, primed for the liquidity thaw.

The Turning Tide

The Fed isn’t done tightening liquidity; it’s done pretending it can withdraw forever. This pivot—to stability over shrinkage—marks the trough. Reserves hold at $6.6 trillion; markets, per ISM’s ninth straight manufacturing contraction, crave the breather. For investors, it’s a call to action: position in liquidity proxies (BTC, QQQ calls) before the “Standing Repo Era” normalizes. History rhymes; AI amplifies. The supercycle whispers—don’t ignore it.

John Ian Lau is a contributing editor at Solomon Grey Capital, blending traditional finance with AI-driven alpha. Views are his own.