The Timeless Trap: Why Investors Still Chase Highs and Flee Lows in a Record Bull Market

- investment33

- Dec 26, 2025

- 3 min read

By John Ian Lau, Contributing Editor, Solomon Grey Capital

“Buy low, sell high” remains the most enduring axiom in investing, yet its simplicity belies the profound difficulty of putting it into practice. In a year like 2025, where U.S. equity markets have surged to repeated all-time highs—driven by retail inflows that are tracking at nearly twice the five-year average—the gap between theory and execution has never been more apparent. Retail investors, who now account for roughly 20% of U.S. stock market trading volume as of the third quarter, continue to pour capital into overheated assets, often at the precise moment when professional money managers are trimming positions.

Consider the data: Through the first half of 2025, retail traders netted $155.3 billion in purchases of single stocks and ETFs, a pace that has accelerated by 53% from the prior year’s already elevated levels, according to Vanda Research. This frenzy aligns with classic behavioral patterns documented in studies like those from Dalbar, which historically show retail investors underperforming benchmarks by 1.5% to 4% annually due to poor timing—buying into euphoria and selling amid panic. In contrast, institutional players, including hedge funds, have been net sellers of equities in recent months, capitalizing on the liquidity provided by this retail surge. As one Goldman Sachs report noted earlier this year, options trading volumes—a proxy for speculative retail activity—hit $420 billion notional per day in 2025, underscoring how fear of missing out (FOMO) drowns out rational analysis.

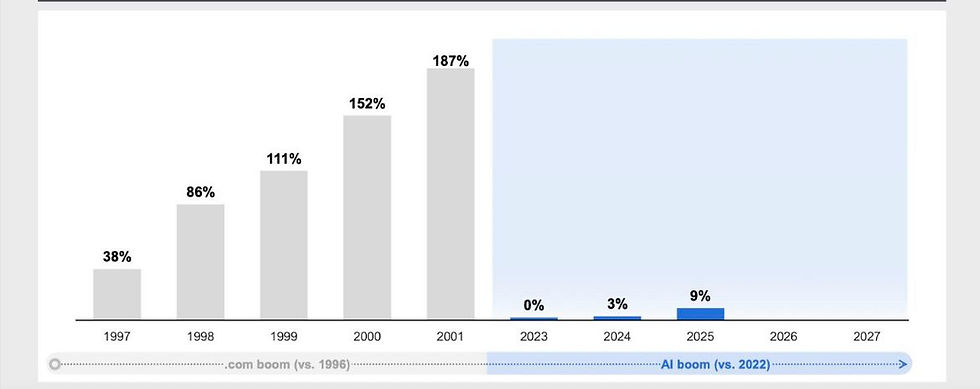

This cycle isn’t a market malfunction; it’s a reflection of unchanging human psychology. Behavioral finance has long identified biases like herd mentality and loss aversion as culprits. When asset prices climb and headlines trumpet success stories—from AI darlings to meme stocks—retail crowds flock in, inflating valuations further. Smart money, having accumulated positions during quieter, cheaper periods, then harvests gains by offloading to the latecomers. The inevitable correction follows, prompting panic sales at depressed prices and resetting the board for the next rotation. It’s a pattern that enables disciplined investors to compound wealth over time, while the masses endure whipsaw losses.

But could artificial intelligence disrupt this age-old dynamic? Proponents argue yes: AI-driven tools, from robo-advisors to algorithmic trading systems, promise to strip emotion from decisions by analyzing vast datasets in real time. Platforms like those from Capital.com already employ AI to flag behavioral red flags—such as overtrading during volatility spikes or chasing trending assets—helping users counteract biases like confirmation seeking or recency effects. Research in the Journal of Interdisciplinary Economics Research suggests AI can identify hidden patterns in investor behavior, potentially reducing fee drag and improving portfolio efficiency. In theory, machine learning models could optimize entry and exit points with precision unattainable by humans, turning the “buy low, sell high” mantra into an automated reality.

Yet the reality is more nuanced. If AI were an unassailable solution to psychological pitfalls, quantitative hedge funds—powered by sophisticated algorithms and AI—would dominate the industry outright. Rhetorically, one might ask: Why, then, have quants not eclipsed all competitors? In 2025, while quant strategies capitalized on market swings to deliver strong first-half returns, they weren’t immune to turbulence; MSCI data highlighted a “quant wobble” over the summer, with cumulative returns nearly double model forecasts but marred by sharp drawdowns tied to factors like short interest and profitability. Overall, the hedge fund universe reached a record $5 trillion in assets under management by mid-year, per HFR, with multi-strategy funds—blending quant models with human discretion—outperforming pure algorithmic approaches amid elevated leverage and macro shifts. Traditional funds, relying on fundamental analysis and qualitative judgment, have held their own, suggesting AI excels at pattern recognition but falters in unpredictable environments, such as black swan events or regime changes where data alone proves insufficient. Overfitting to historical trends or failing to adapt to novel risks remains a quant Achilles’ heel, reminding us that markets are as much about human narratives as mathematical certainties.

Ultimately, the most reliable path forward eschews shortcuts, AI-assisted or otherwise. Disciplined long-term investors thrive by adhering to a “boring” playbook: Identify quality assets with enduring value, invest consistently—ideally starting early to harness compounding—and resist the urge to sell winners absent a compelling need. In 2025’s bull run, this meant ignoring the siren call of crowded trades and focusing on fundamentals. For those lacking the temperament or expertise to go it alone, partnering with qualified financial advisors offers a prudent safeguard, ensuring decisions align with personal goals rather than market whims. As history shows, the real edge in investing isn’t outsmarting the crowd—it’s outlasting it.